FingerMotion, Inc. (NASDAQ: FNGR) is an emerging player in the tech and mobile services sector. As a dynamic company, it has shown substantial growth potential, making it an intriguing option for investors. In this article, we will delve into a comprehensive analysis of FingerMotion’s stock, its current performance, and forecast its potential trajectory over the next 3, 6, and 12 months.

Company Overview

FingerMotion, a mobile data and services company, is primarily engaged in providing payment and recharge services, data plans, and mobile phones. It is also expanding into the big data sector, which has the potential to significantly boost its revenue streams. The company’s recent financial results and strategic initiatives are paving the way for potential growth in the coming months.

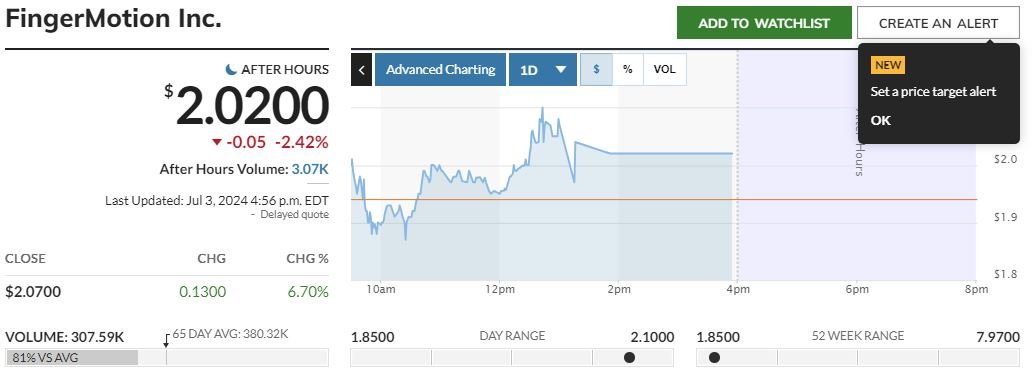

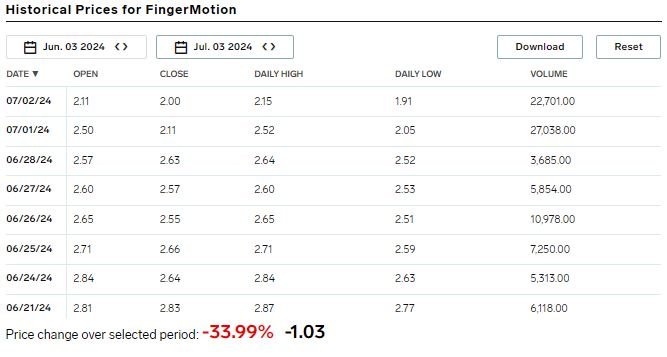

Current Performance

As of July 2024, FingerMotion’s stock is trading at approximately $2.07 per share, with a market cap of $109.11 million (MarketBeat). Despite some volatility, the company’s robust business model and innovative services have caught the attention of investors. In recent quarters, FingerMotion reported significant revenue growth, with projections indicating a rise from $35.79 million in 2023 to an estimated $128.86 million in 2024 (Stock Analysis).

Financial Analysis

Earnings and Revenue

For the fiscal year ending in February 2024, FingerMotion reported a notable revenue increase, which grew by 260.03% compared to the previous year. This growth is driven by the company’s expansion into new markets and its big data initiatives (MarketBeat). Despite a net income loss of $3.76 million, the revenue trajectory shows promising signs for future profitability.

Stock Valuation

FingerMotion’s stock has experienced fluctuations, largely due to market conditions and company-specific news. With a price-to-sales ratio of 3.05 and a book value of $0.23 per share, the stock presents a unique value proposition for investors looking for growth in the tech sector (MarketBeat) (Stock Analysis).

3, 6, and 12-Month Forecasts

3-Month Forecast

In the short term, FingerMotion’s stock price is expected to experience moderate growth. With the company’s recent strategic partnerships and new product launches, the stock could reach approximately $2.50 to $3.00 per share. These developments are likely to generate increased investor interest and drive up the stock price.

6-Month Forecast

Looking ahead six months, FingerMotion’s continued expansion into the big data market and its increasing revenue streams are expected to further bolster its stock performance. Analysts predict the stock could rise to the range of $3.50 to $4.00 per share, assuming the company maintains its current growth trajectory and successfully capitalizes on its market opportunities.

12-Month Forecast

Over the next year, FingerMotion’s ambitious growth plans and market expansion efforts could significantly enhance its stock value. If the company continues to execute its strategy effectively, the stock price might reach between $4.50 and $5.00 per share. Long-term investors could benefit from holding the stock as FingerMotion solidifies its position in the tech and mobile services industry.

Conclusion

FingerMotion, Inc. presents a compelling investment opportunity with its innovative approach and robust growth prospects. While the stock has shown volatility, its potential for significant returns makes it a stock to watch. Investors should stay informed on the company’s latest developments and market trends to make well-timed investment decisions.

For more detailed analysis and real-time updates on FingerMotion (FNGR), visit MarketBeat and Stock Analysis.