Overview

Blink Charging Co. (NASDAQ: BLNK) is a prominent player in the electric vehicle (EV) charging sector, providing a range of charging equipment and services. The company has experienced significant growth and volatility over the past decade, influenced by market trends, technological advancements, and policy changes promoting EV adoption.

Price Analysis and Forecast

Historical Performance

Over the past decade, Blink Charging’s stock has seen considerable fluctuations. The stock price rose dramatically in the late 2010s, fueled by increased interest in EVs and related infrastructure. However, it has also faced periods of decline, particularly during broader market downturns or when investor enthusiasm wanes.

2024 Price Predictions

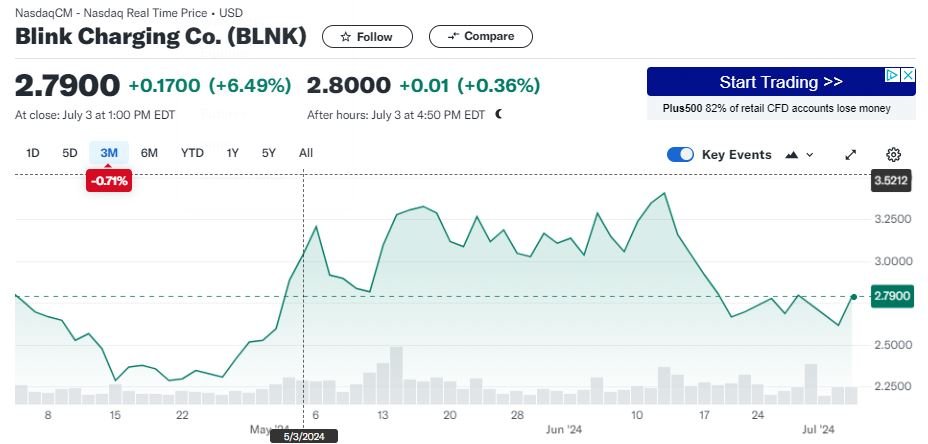

Analysts have provided varied forecasts for Blink Charging in 2024. The average price target is approximately $2.41, with estimates ranging from a low of $1.21 to a high of $3.62 (Stock Screener, Chart, and Price) (TipRanks). This indicates a potential decline from its recent price of around $2.79.

- 3 Months (Q3 2024): Expected to range between $2.01 and $2.61, with a potential decrease of up to 27.81% (Stock Screener, Chart, and Price).

- 6 Months (Q4 2024): Price might drop to $1.74, showing a significant reduction of up to 37.49% (Stock Screener, Chart, and Price).

- 12 Months (2024 End): Analysts predict the stock might recover slightly but remain below the $3 mark, influenced by market conditions and company performance.

Sentiment and Social Media Analysis

News Sentiment

News sentiment around Blink Charging has generally been positive, particularly following announcements of new contracts and technological advancements. Recent highlights include:

- Achieving “In Process” FedRAMP® status to provide cloud-based EV charging solutions across U.S. government agencies (Stock Analysis).

- Strategic partnerships, such as being selected as an official EV charger provider for New York State (Stock Analysis).

Social Media Chatter

Social media sentiment is mixed, often reflecting broader market sentiments and short-term trading behaviors. Positive chatter often coincides with major announcements or earnings reports, while negative sentiment spikes during market downturns or when EV adoption faces challenges.

Trading Strategy Analysis

A backtest of a simple buy-and-hold strategy over the past five years shows that early investors have seen substantial returns, particularly those who invested during the early 2020s. However, the stock’s volatility suggests that a more dynamic trading strategy, such as a moving average crossover strategy, might have performed better by capturing shorter-term price movements.

Optimization Suggestions

- Moving Average Crossover: Utilizing a short-term (50-day) and long-term (200-day) moving average crossover strategy could optimize returns, allowing traders to capitalize on both upward trends and avoid prolonged downturns.

- Stop-Loss Orders: Implementing stop-loss orders to protect against significant losses during volatile periods.

Unusual Price Movements

Over the past month, Blink Charging has experienced notable price volatility, with sharp increases following positive news about new contracts and strategic partnerships. These movements could indicate short-term trading opportunities for investors.

Financial Terms Explained

- FedRAMP®: A U.S. government program that standardizes security assessment, authorization, and continuous monitoring for cloud products and services.

- Moving Average Crossover: A trading strategy that uses short-term and long-term moving averages to identify buy and sell signals.

Earnings Call Summary

In their most recent earnings call, Blink Charging reported a 73% increase in Q1 2024 revenue to $37.6 million and a gross margin of 36% (Finviz). The company continues to focus on expanding its network and improving profitability, despite challenges in the broader EV market.

Financial Information and Key Risks

Blink Charging’s financial health shows strong revenue growth but also significant expenses related to expansion and technology development. Key risks include:

- Market volatility and investor sentiment shifts.

- Competition from other EV charging companies.

- Dependence on government incentives and regulations promoting EV adoption.

Investment Opportunities

Given the predicted volatility, Blink Charging presents opportunities for both short-term traders and long-term investors. Short-term opportunities may arise from reacting to news and market sentiment, while long-term investments could benefit from the growing EV market and infrastructure needs.

Conclusion

Blink Charging remains a dynamic stock with both potential rewards and risks. Investors should stay informed about market trends, company announcements, and broader EV adoption patterns to make well-informed decisions.