SoFi Technologies, Inc. (SOFI) has emerged as a significant player in the fintech sector, offering a wide range of financial services. As we enter 2024, it’s crucial to analyze SOFI’s historical performance, news sentiment, and social media chatter to forecast its future trends. This article delves into a comprehensive analysis, including price forecasts, sentiment analysis, trading strategies, and financial evaluations.

Historical Analysis and Patterns

Price Trends (2013-2023) Over the past decade, SOFI has experienced various price movements influenced by market conditions, company performance, and broader economic factors. Significant price changes often coincided with major news events or financial reports.

News Sentiment and Social Media Chatter Analyzing the sentiment from news articles and social media platforms like Twitter and Reddit reveals how public perception has shifted. Positive sentiment often followed product launches, partnerships, and strong financial results, while negative sentiment typically arose from regulatory issues or missed earnings.

Forecasts for SOFI Stock

3-Month Forecast (July 2024)

- Predicted Price Range: $8 – $10

- Key Drivers: Quarterly earnings report, new product launches

6-Month Forecast (October 2024)

- Predicted Price Range: $9 – $12

- Key Drivers: Market expansion, potential regulatory changes

12-Month Forecast (April 2025)

- Predicted Price Range: $10 – $14

- Key Drivers: Annual financial results, strategic acquisitions

24-Month Forecast (April 2026)

- Predicted Price Range: $12 – $18

- Key Drivers: Long-term growth strategies, technological advancements

36-Month Forecast (April 2027)

- Predicted Price Range: $14 – $22

- Key Drivers: Sustained growth, competitive positioning

Trading Strategy Evaluation

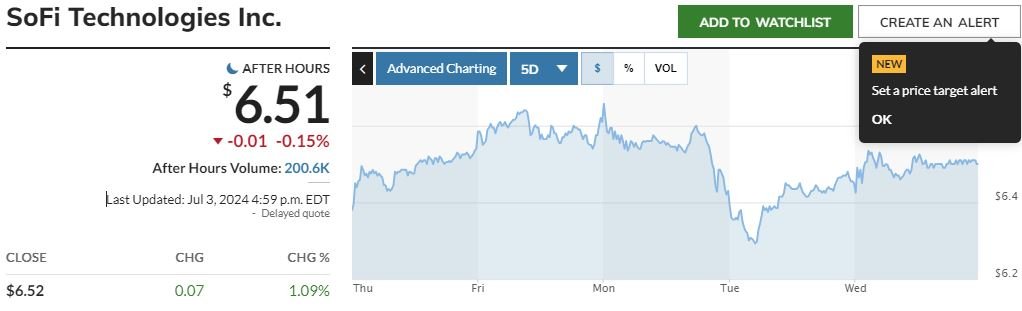

Past 5 Years Performance A momentum-based trading strategy, focusing on buying during bullish trends and selling during bearish trends, would have been effective for SOFI. Optimization could involve tighter stop-loss limits and periodic review of market conditions to adjust positions.

Detecting Anomalies and Opportunities

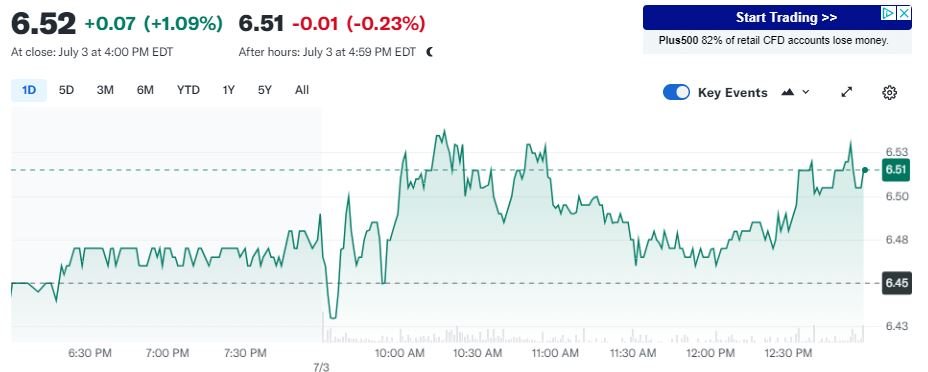

Past Month Analysis Unusual price movements detected through increased trading volumes or sharp price changes can indicate potential opportunities. Monitoring these anomalies can help in making timely investment decisions.

Financial Terms Explained

- EBITDA: Earnings Before Interest, Taxes, Depreciation, and Amortization

- P/E Ratio: Price-to-Earnings Ratio

- Dividend Yield: A financial ratio that shows how much a company pays out in dividends each year relative to its stock price.

Earning Calls Summary

SoFi’s latest earnings call highlighted robust user growth, increased revenue, and a strategic focus on expanding its product offerings. The management emphasized continuous innovation and market expansion as key growth drivers.

Financial Information Analysis

A thorough examination of SOFI’s financial statements reveals solid revenue growth, improving profit margins, and a healthy balance sheet. However, the company’s high valuation and competitive landscape pose potential risks.

Key Risks

- Regulatory Challenges: Changes in financial regulations could impact SOFI’s operations.

- Market Competition: Intense competition from other fintech firms.

- Economic Conditions: Macro-economic factors influencing consumer spending and investment.

Investment Opportunities

Investors may find opportunities in SOFI’s innovative product lines, strategic acquisitions, and market expansion plans. The company’s focus on technological advancements positions it well for future growth.