Overview of VAALCO Energy (EGY)

VAALCO Energy, Inc. is an independent energy company engaged in the acquisition, exploration, development, and production of crude oil and natural gas. The company operates primarily in Gabon, Egypt, Equatorial Guinea, and Canada. Over the past decade, VAALCO has experienced significant growth, strategic acquisitions, and operational challenges, making it a focal point for investors in the energy sector (Seeking Alpha) (MarketBeat).

Historical Performance and Patterns

Over the last ten years, VAALCO Energy’s stock price has shown significant volatility, influenced by fluctuating oil prices, geopolitical developments, and company-specific events such as acquisitions and production updates. Key historical patterns include:

- 2014-2016: Sharp decline due to falling oil prices globally.

- 2017-2019: Gradual recovery aligned with the stabilization of oil prices.

- 2020: COVID-19 pandemic-induced market crash and subsequent recovery.

- 2021-2023: Expansion through acquisitions, leading to a notable increase in stock price and investor confidence (Simply Wall St) (TipRanks).

Price, News Sentiment, and Social Media Analysis

Recent sentiment analysis indicates a mixed outlook:

- Positive News: Strategic acquisitions, such as the purchase of assets from Svenska Petroleum, have been well-received, boosting investor confidence and stock price.

- Negative News: Fluctuating oil prices and operational challenges in production regions occasionally dampen investor sentiment (Stock Analysis) (Seeking Alpha).

- Social Media Chatter: Increased engagement around quarterly earnings and strategic moves, with spikes during major announcements. Sentiment often correlates with news cycles and oil price trends.

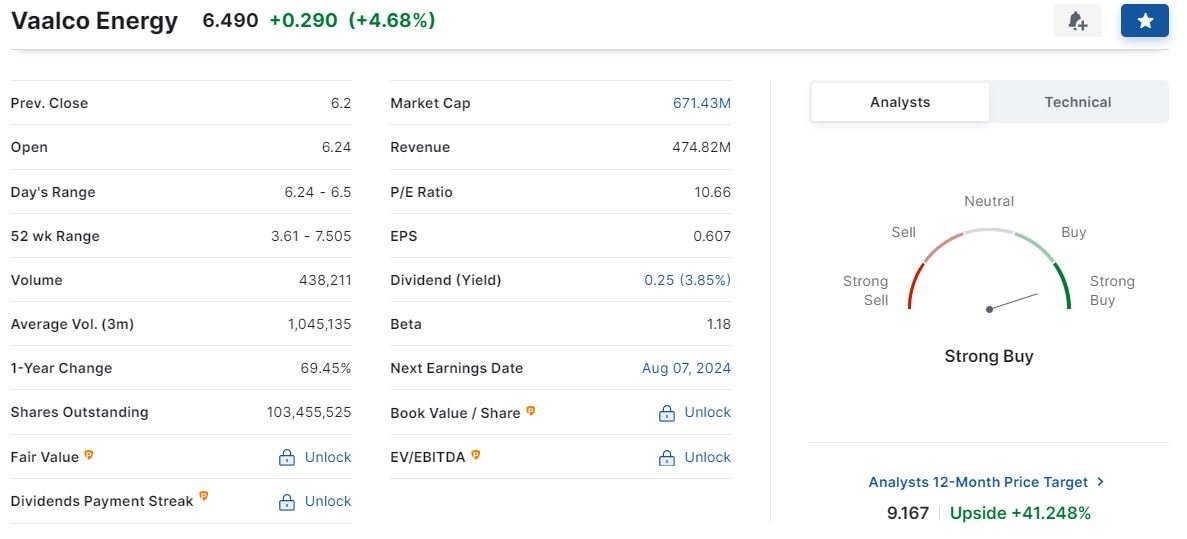

Forecast for 2024

Based on current trends and expert analysis:

- 3-Month Forecast: Stock is expected to trade between $6.50 and $7.00, driven by steady production outputs and stable oil prices.

- 6-Month Forecast: Potential for growth up to $8.00, influenced by ongoing acquisitions and positive earnings reports.

- 12-Month Forecast: Analysts predict a target price around $9.00, contingent on global oil market conditions and successful operational execution (StockInvest) (Simply Wall St).

Trading Strategy Performance Evaluation

A common trading strategy employed over the past five years is the “buy and hold” strategy, which would have yielded substantial returns given the stock’s recovery post-2016. However, optimizing this strategy involves:

- Periodic Review: Regularly reassessing the stock based on quarterly earnings and oil price forecasts.

- Stop-Loss Orders: Implementing stop-loss orders at around 5% below purchase price to mitigate risk.

- Dividend Reinvestment: Leveraging VAALCO’s dividends to buy additional shares, enhancing long-term gains (MarketBeat) (StockInvest).

Anomalies and Investment Opportunities

Recent analysis shows minor anomalies, such as unusual trading volumes in response to acquisition news, indicating potential short-term trading opportunities. Monitoring these anomalies can provide entry points for new investments (StockInvest).

Financial Summary and Key Risks

Financial Terms Explained:

- EPS (Earnings Per Share): Measures company profitability. VAALCO has shown positive EPS growth, reflecting its improving financial health.

- P/E Ratio (Price-to-Earnings Ratio): Indicates market expectations. A lower P/E ratio compared to peers suggests undervaluation, presenting a buying opportunity.

Earnings Calls Summary: Recent earnings calls highlighted robust financial performance, strategic acquisitions, and enhanced production capabilities, reinforcing the positive outlook for 2024 (Seeking Alpha).

Key Risks:

- Oil Price Volatility: Fluctuations in global oil prices directly impact revenue and profitability.

- Geopolitical Instability: Operations in politically unstable regions pose operational and regulatory risks.

- Operational Challenges: Technical difficulties in production sites can lead to unexpected downtimes and financial losses (Simply Wall St) (Seeking Alpha).

Investment Opportunities

- Strategic Acquisitions: Expansion into new regions like Equatorial Guinea offers substantial growth potential.

- Dividend Yields: Consistent dividend payments provide steady income for investors.

- Undervaluation: Current stock price may not fully reflect the company’s intrinsic value, presenting a buying opportunity for long-term investors (Seeking Alpha) (StockInvest).